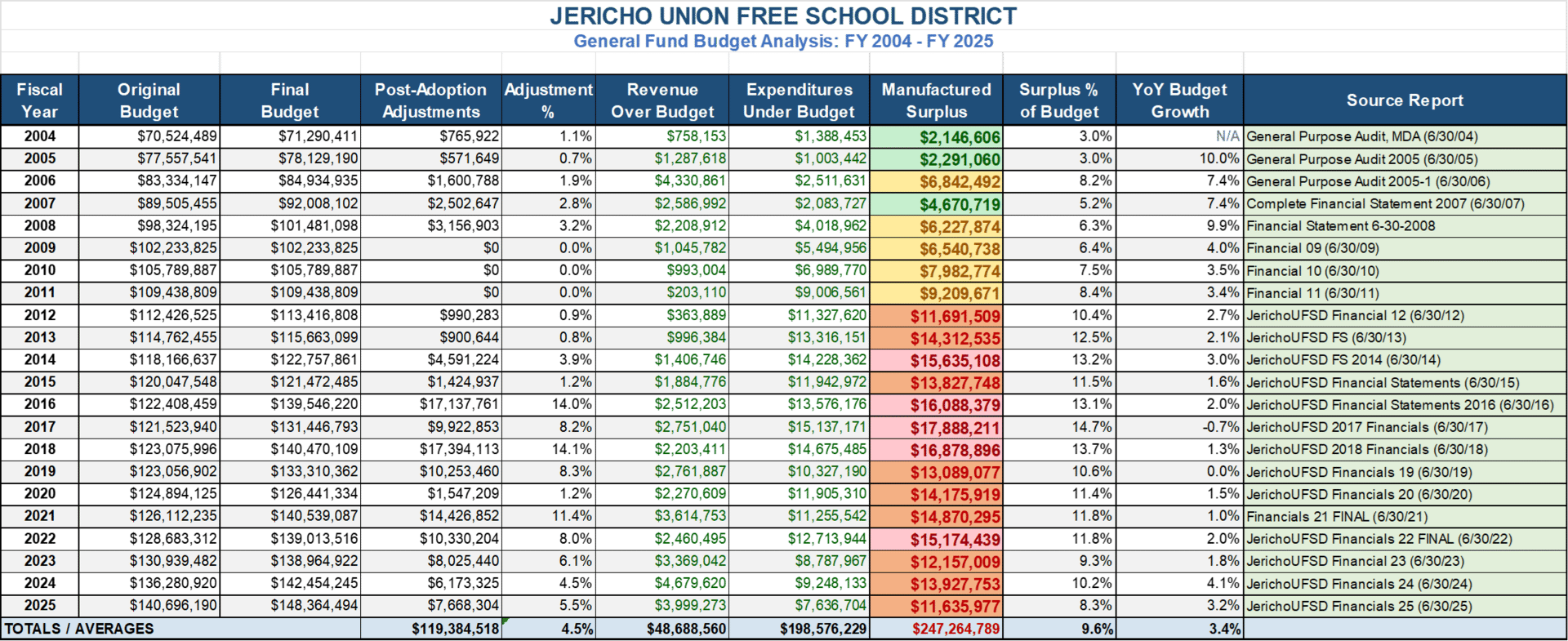

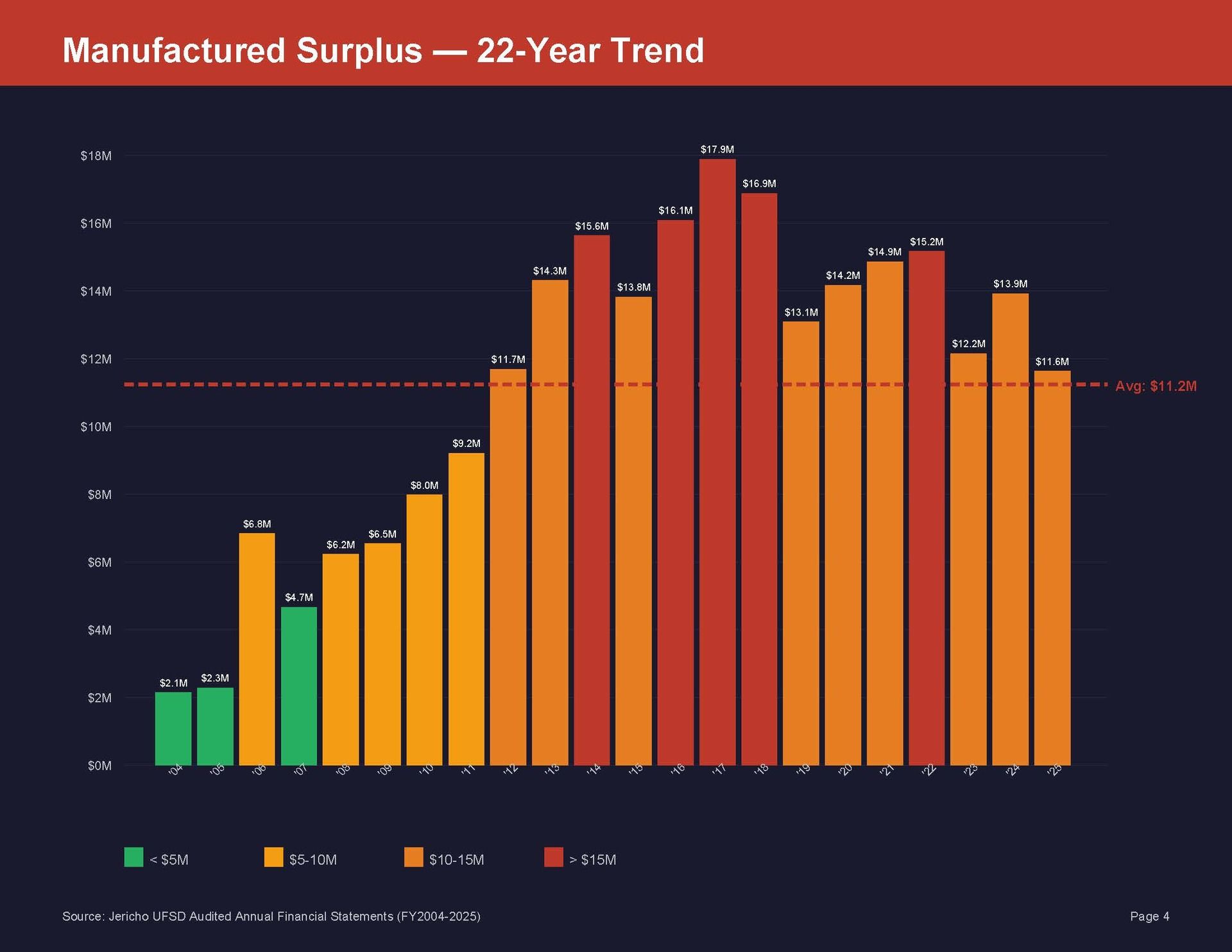

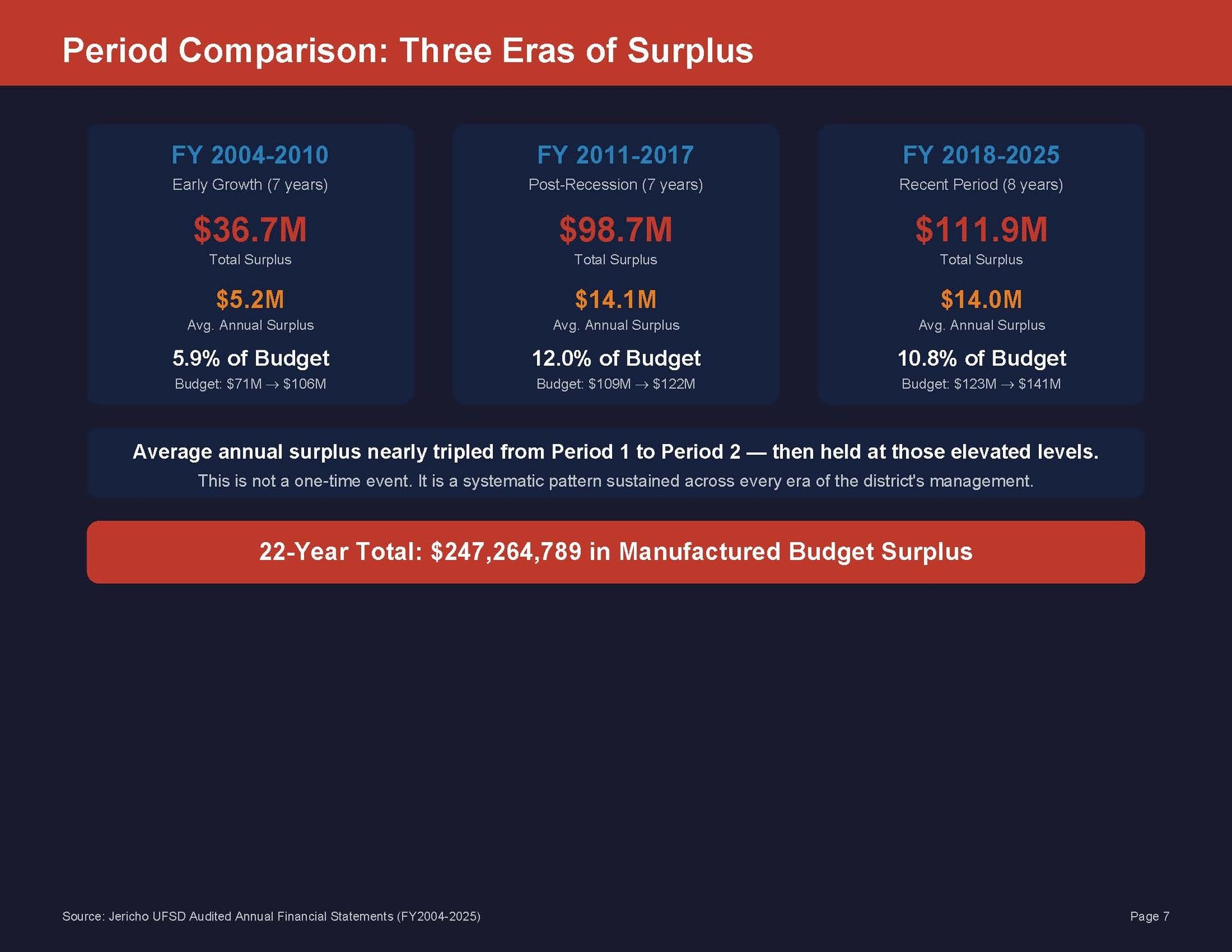

In 22 consecutive fiscal years, Jericho UFSD has never once produced an accurate budget for either revenue or expenditures. The district generated $247.3 million in manufactured surplus—$11.2 million per year on average—representing systematic over taxation of residents. Administration cannot claim both fiscal expertise worthy of premium compensation and an inability to budget accurately for two decades.

Full PDF available for download or scroll to the bottom for images associated with the analysis.

JERICHO UNION FREE SCHOOL DISTRICT General Fund Budget Analysis: FY 2004 - FY 2025

DEFINITIONS

Original Budget

The total General Fund budget adopted by voters at the annual budget vote, including all expenditures and inter fund transfers (Total Expenditures and Other Uses).

Final Budget

The Original Budget plus post-adoption adjustments: prior year encumbrances carried forward, appropriated fund balance (surplus) designated by the Board, appropriated reserves (retirement, employee benefits, capital), and voter-approved capital reserve expenditures.

Post-Adoption Adjustments

The difference between Final Budget and Original Budget. These are NOT new taxes — they represent accumulated surplus, reserves, and prior-year commitments added to the budget after adoption. Large adjustments (e.g., FY2016-2018) often include voter-approved capital reserve spending.

Revenue Over Budget

The amount by which Actual Revenues exceeded the Final Budget Revenue estimate (Actual Revenue minus Final Budget Revenue).

Expenditures Under Budget

The unencumbered balance: Final Budget minus Actual Expenditures minus Year-End Encumbrances. This is the amount budgeted but neither spent nor committed.

Manufactured Surplus

Revenue Over Budget plus Expenditures Under Budget. Represents the total annual gap between what was budgeted and what was actually needed — money collected from taxpayers beyond actual district needs.

Each year, the district appropriates a portion of accumulated surplus into the next year's budget. This is NOT a refund or tax reduction — no money goes back to taxpayers.

The surplus is recycled into an ever-growing budget. As the table shows, the adopted budget nearly doubled over this period — from $70.5M to $140.7M — while surplus continued to accumulate every single year.

THE SURPLUS CYCLE

The cycle works like this: the district over-collects taxes → surplus accumulates → a fraction is fed back into the next (larger) budget → the district over-collects again. The surplus is not reduced — it compounds. Taxpayers funded $247.3 million more than was actually spent.

If the district had budgeted accurately, this surplus would never have existed — and there would have been no need to "put it back."

Jericho Union Free School District 22-Year Budget Surplus Analysis

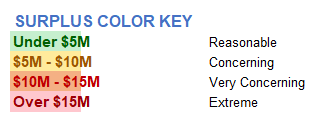

22-Year Budget Analysis — FY2004 to FY2014

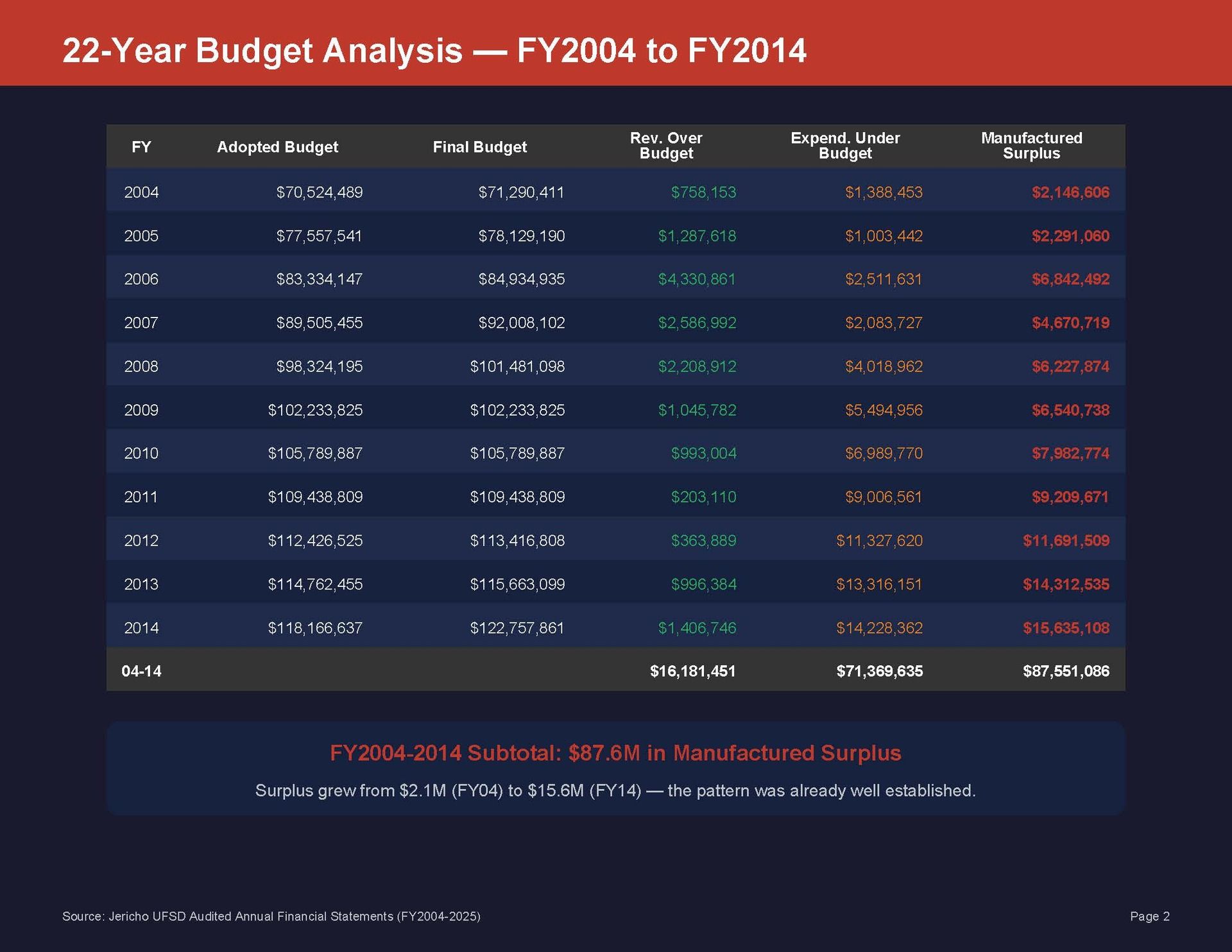

22-Year Budget Analysis — FY2015 to FY2025

Manufactured Surplus — 22-Year Trend

Where the Surplus Comes From

The Surplus Cycle: Money Goes to the Budget, Not Taxpayers

Period Comparison: Three Eras of Surplus

Key Findings